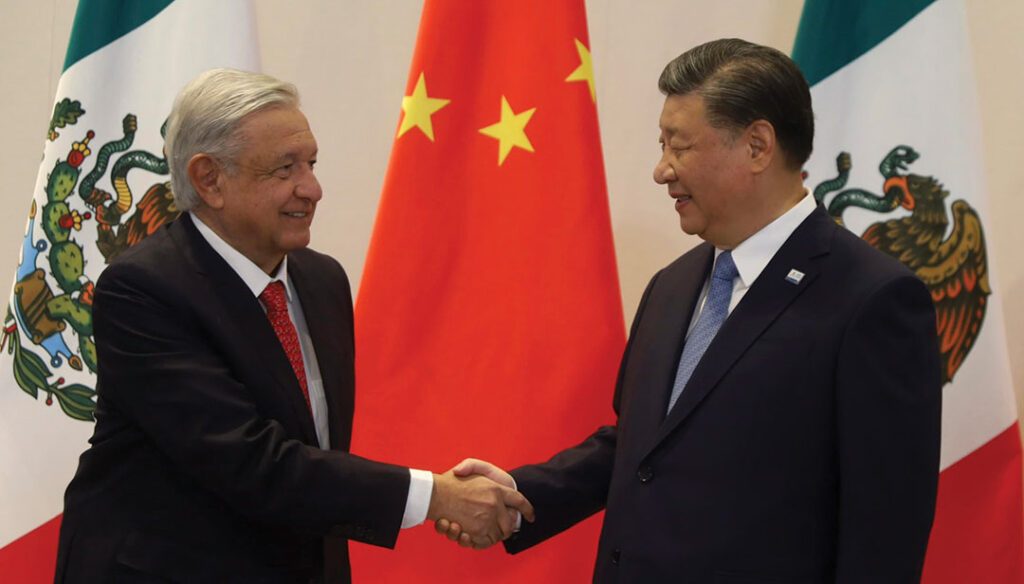

Mexican President Andrés Manuel López Obrador shakes hands with Chinese Communist Party General Secretary Xi Jinping in November 2023 at the Asia-Pacific Economic Cooperation conference in San Francisco. The People’s Republic of China has been expanding commercial and political ties with Mexico. Reuters

DR. R. EVAN ELLIS/U.S. ARMY WAR COLLEGE

Mexico’s President Andrés Manuel López Obrador “AMLO” publicly reached out to Chinese counterpart Xi Jinping in March 2023, asking for help to manage the flow of fentanyl from the People’s Republic of China (PRC) into Mexico. The appeal officially, if indirectly, acknowledged the PRC’s role in the flow of narcotics through Mexico responsible for the deaths of over 100,000 residents in the United States per year, as well as the multidimensional fashion in which the PRC’s licit and illicit engagement in Mexico impacts U.S. security, according to ABC News.

Mexico’s shared border with the U.S. and the integration of the U.S. and Mexican economies in the framework of the U.S.-Mexico-Canada Agreement (USMCA) make it strategically vital. Its cooperation with the U.S. on matters of transnational organized crime and migration across the 3,111-kilometer shared U.S.-Mexico border is also vital to U.S. national security.

While Mexico is not bound to the PRC by the ties of geography, commerce and family that it shares with the U.S., its ties to China are far greater and more longstanding than are commonly recognized. From the 16th century, the Mexican port of Acapulco served as a hub for the famous Manilla Galleons exchanging the new world’s silver and other treasures for Asian goods. In 2003, Mexico was one of the first countries to be recognized by the PRC as a strategic partner in the region.

The AMLO government has shown a strong interest in engaging with the PRC. Mexican Prime Minister Marcelo Ebrard made a high-profile trip to China in July 2019. And Mexico — as head of the Community of Latin American and Caribbean States (CELAC) — played a key role in hosting the 2021 China-CELAC summit, including the three-year plan developed there for deepening the PRC’s relationship with the region, according to the Mexican and PRC governments.

Although Mexico has had limited success in exporting to China, its imports from the PRC of a broad array of consumer products and intermediate goods caused its overall trade to balloon from $117 billion when the PRC was admitted into the World Trade Organization in 2001 to $137 billion by 2022, with its $126 billion in imports from China more than 11 times its $10.9 billion in exports to China that year, according to the International Monetary Fund.

Over the past two decades, PRC-based companies have also expanded their presence in retail, manufacturing and other sectors in Mexico, often with an eye to access the U.S. market through USMCA. Between 2000 and 2021, the Mexico-based China-Latin America and Caribbean Academic Network identified 110 individual Chinese investments in the country totaling $16.9 billion, almost 10% of total PRC investment in the region during the period. Chinese automotive manufacturers present in Mexico include Foton, BAIC, JAC, Chang’an, and BYD, among others. As Chinese companies maneuver to preserve access to the U.S. market amid the move toward “nearshoring,” PRC-based companies have become the most significant new investors in Mexican U.S. border states such as Nuevo Leon.

From the beginning, much of that Chinese investment has had a strategic intent. Examples include control by Hong Kong-based Hutchinson Port Holdings of seven strategic Mexican port and logistics operations on both the Atlantic and Pacific coasts; rights acquired in 2016 to a Mexican oilfield in the Perdido basin in the Gulf of Mexico adjacent to U.S. waters; a key PRC role in building AMLO’s signature infrastructure project, the $7.4 billion Maya tourist train; and the PRC-linked company Ganfeng’s role in the Bacanora lithium deposit in the Sonora desert, one of the largest such lithium deposits in the hemisphere.

In November 2020, China State Power Investment Corp. acquired Zuma Energy — one of the most important renewable energy producers Mexico — a striking contrast to the general AMLO propensity to privilege Mexican companies over private foreign producers.

In the digital domain, the Chinese telecommunications company Huawei, which has come under scrutiny for its PRC-linked ownership and related security concerns, is the leading candidate to supply 5G in Mexico, capping an effort over two decades to achieve a dominant position as a provider of telecommunications equipment and infrastructure in the country, alongside other Chinese providers. Huawei has also aggressively marketed its cloud computing services to Mexican technology startups, according to techcapital.com, an online news platform.

In the security systems sector, China-based Hikvision has captured a significant portion of the Mexican market. In online commerce, Alibaba has a dominant position as a business-to-business supplier, while during COVID-19, China’s Didi Chuxing overcame resistance from Mexico’s traditional taxi drivers and advanced significantly to capture a dominant position in Mexico’s ride-booking market, besting rival Uber. In finance, Chinese banks such as HSBC, ICBC and Bank of China play an expanding role in the country, according to Reuters and Digital Trend, an online tech news organization.

In support of deepening Mexico’s ability to engage with China, the PRC has established six Confucius Centers in the country and provides scholarships for Mexican students to study in the PRC.

As AMLO’s government has pursued policies that privilege state companies and caused discontent among private investors, the PRC’s leverage has arguably expanded. Ganfeng’s position in lithium has already led AMLO to back off early declarations on nationalization, according to the news site Mexicobusiness.com.

In the security sector, Mexico has long sent a limited number of military personnel to the PRC for professional military education, and Chinese and Mexican military institutions periodically exchange visits. In the context of Mexico’s close military relationship with the U.S. under the prior Felipe Calderón and Enrique Peña Nieto presidencies, the country has not acquired significant military hardware from PRC-based defense companies or conducted large-scale training exercises with the PRC, according to the globalamericans.org, a Latin American think tank.

The expansion of PRC commercial ties with Mexico has also facilitated illicit ties. Although denied by its government, the PRC is a key supplier of fentanyl and precursors for other synthetic drugs to Mexican cartels such as Sinaloa and Jalisco Nuevo Generacion. The penetration of Mexico’s financial system by PRC banks and the expansion of trade has also helped Chinese institutions to play an important role in laundering bulk cash by Mexican criminal organizations, according to reports by The Associated Press and Yahoo News.

The U.S. continues to respect Mexico’s right as a sovereign state to conduct legitimate commercial and political interactions with the PRC and its companies. It strongly advocates, however, that it do so within a framework of transparency, good governance, rule-of-law and an equal playing field for all. While some in Mexico may always question Washington’s intentions, close Mexico-U.S. ties of geography, commerce and family give Washington a strong interest in Mexico’s prosperity, the health of its democratic institutions, and a relationship of trust, whether on China or other matters of mutual interest.